By Dr. Joe Webb

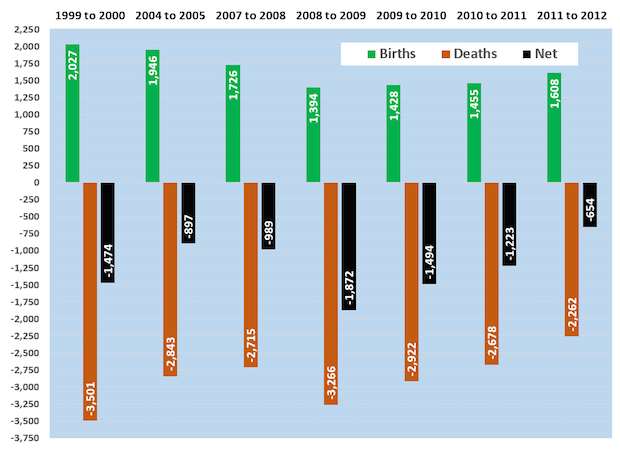

Even the usual industry dynamics are dynamic. The latest commercial printing industry birth-death data comparing 2012 to 2011 show a rising birth rate and a declining death rate. The +1608 births and -2262 deaths in 2012 were recent lows, as was the net change of only -654 establishments.

Births and deaths data are not that easy to interpret. It's important to view these data in context: much of these changes are for tax planning or “poor man's consolidation” where two owners close their businesses and open one together. In the process, any of the tax planning or structures that are common to family businesses are purged, such as family members on the payrolls, use of company vehicles, etc.

Mergers and acquisitions are for companies doing more than $10 million in annual revenues. Many in the death category are businesses that really died the year before but they kept the business entity open one more year to close the books while they sold off equipment or dealt with final distributions and taxes. This is why two-thirds of the deaths are in establishments with 1-4 employees as businesses shrink until they disappear.

Not all of this is a restructuring industry in the throes of creative destruction. Nor are the data are not a magnetic attraction to invest in the industry by outside entrepreneurs, but often related to tax planning or changes to the nature of ownership.

The birth-death data, though filled with these kinds of issues that blur the essence of the trends. An underappreciated aspect of these reformations of businesses is the reallocation of capital that drives this process. Closing and opening of businesses take the unsatisfactory allocation of capital (equipment, finance, knowledge, processes, skill, etc) that no longer matches the nature of marketplace demand. and reallocates it to new purposes. This shedding of resources that no longer create value frees up capital for a superior competitive match with the new business in the hopes that the reconfigured engine of value creation will be better rewarded.

The chart shows the data for selected past years and the most recent ones. The industry is still shrinking as inefficient businesses are purged. We'd like to say it's leaner and more profitable as a result, but total industry profits remain flat. The industry's smaller and steadier but not better... yet.